Marketers are always on the lookout for the next big thing to give them the edge against the ever-ravenous competition or help them stay front-of-mind with consumers facing an infinite number of options (and distractions!).

And the current next big thing in marketing is undoubtedly retail media.

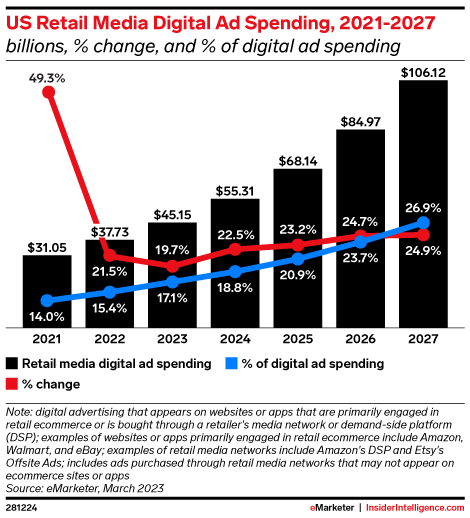

Not too long ago it may have been widely viewed as the red-headed stepchild of the dominant twin dynamos of search and social, but these days retail media is the second-fastest-growing major ad format in the US and spending is expected to surpass traditional TV by mid-decade, according to eMarketer.

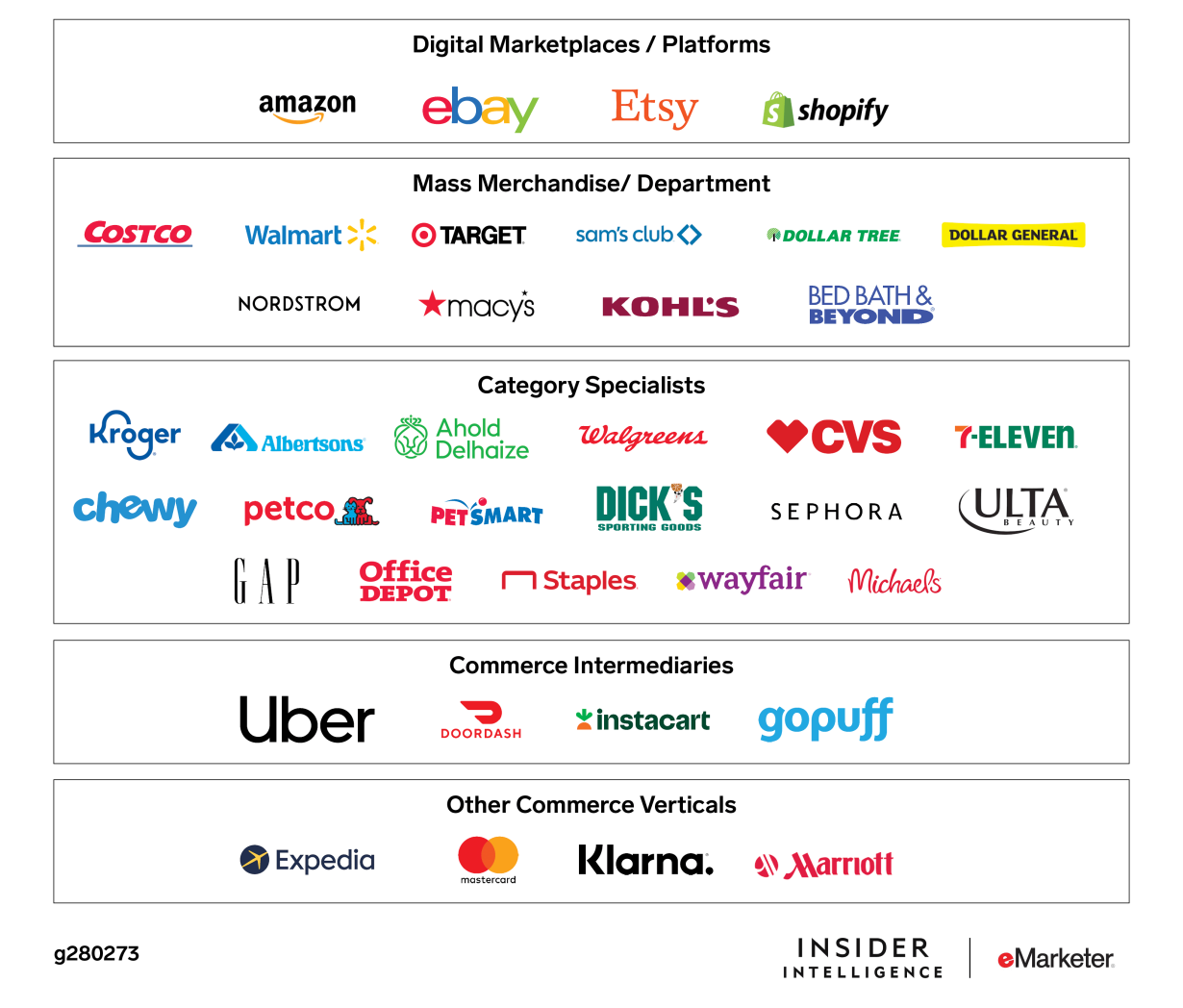

Amazon is undoubtedly the current king in terms of both reach and ad capabilities, but there are a plethora of players populating the surprisingly diverse retail media landscape, including other digital-first operations like Wayfair; marketplaces like eBay; mass merchandisers like Walmart, Target, and Best Buy; grocers like The Kroger Co. and Albertsons; and delivery services that support retailers like Instacart.

And the number of retail media networks (RMNs) is only growing.

If you’re lagging behind, it’s time to roll up your sleeves and dive into this data-rich world of retail media—so you can figure out which of the options in this supercharged space are the best fit for your business.

Competition rising: Walmart, eBay, and other retail media networks are looking to cut into Amazon’s portion of the retail media pie

Amazon launched the first retail media network back in 2012, and in the last few years it’s invested significantly in its capabilities. There’s no question it’s the most mature of the different networks currently available and the one most marketers are most familiar with.

But other retailers took notice of Amazon’s core value proposition to marketers: leverage our vast stores of first-party data to better connect with and get your products/brand in front of customers who are researching, comparing, and purchasing on the platform.

That’s a lot of value for today’s post-iOS 14.5, data-hungry brands. And Amazon wasn’t the only business that had that kind of behavioral data so close to the conversion point. As more businesses started allocating more spend to retail media networks, new competitors started cropping up everywhere.

Source: eMarketer

Legacy retailers like Walmart, eBay, Target, and more have been moving fast to expand their advertising capabilities to match Amazon’s, even as Amazon itself has continued to set the pace with new capabilities like its demand-side platform (DSP) that opened up its data so brands could target campaigns on the open web or OTT, as well as other options.

But advertisers are hungry for options, and the non-Amazon players have taken note. The two fastest-growing US digital ad businesses this year are RMNs from Walmart and Instacart. eMarketer projects that Walmart’s ad business will grow by 42.0% in 2023 and Instacart’s will increase by 41.3%, outpacing Amazon’s current rate of growth.

Source: eMarketer

It can seem like every retailer, from grocery to department stores, is looking for a way to monetize all of that precious purchase-point data to become an ad network.

But that doesn’t mean that every new retail media opportunity is created equal. If you want to have your cake and eat it too (with the cake being data), you need to choose where you spend your ad dollars carefully.

A good place to start is with the major established non-Amazon retail media networks:

- Walmart: The mass merchandiser is #2 only to Amazon in this space, and has made serious strides to position itself as a significant competitor for Amazon’s ad dollars, currently offering sponsored brand ads, brand stores, video placements, display self-serve (DSS), and their own DSP. Walmart+ is also looking to level up their game through a strong roster of partnerships and the launch of various new engaging ad formats.

- Instacart: Instacart launched Carrot Ads, its self-service ad platform, back in 2020, and has continued to expand its offering to advertisers, including partnering with Sprouts Farmers Market to launch their retail media network. Carrot Ads lets retailers not only advertise on the platform, but also leverage Instacart’s ad tech, ad products, engineering, sales talent, and data insights on their own ecommerce sites.

- Target: Roundel was first created in 2016 as Target’s in-house media company and later reimagined as part of Target’s retail media network, growing by 60% over the past two years. Capabilities include product ads, search ads, co-branded content from influencers, mixed media ads across channels, and display ads.

- eBay: The OG digital marketplace has offered Promoted Listings options to advertisers for quite a while, but they’ve started to step up their retail media game, recently introducing a beta version of Promoted Listings Advanced that gives preferred access to premium ad placements in search and lets advertisers use budget and keyword control features to increase traffic to listings. eBay also has other ad options like Top of Search Display and Native Display ads.

There is one definite trend in retail media that puts Amazon at a disadvantage against retailers like Walmart and Target: the digitization of the in-store experience.

From online to in-store: retail media offers an opportunity to transform the brick-and-mortar experience

Retail media is now a nearly $40 billion industry, but that has always been limited to digital spaces. Now those retail silos are breaking down, and nobody is more excited about that than brick-and-mortar powerhouses like Walmart and Target.

An Insider Intelligence study reported that among the leading brick-and-mortar retailers in the US, most had bigger in-store audiences, including Walmart and Target who both reach Super Bowl-sized audiences.

That’s where non-Amazon retailers have a chance to shine, as Amazon’s physical retail audience (across their Go, Fresh, and Style locations) doesn’t hold a candle to the brick-and-mortar leaders. In fact, Walmart’s in-store audience is almost as big as Amazon’s massive online audience.

Source: Target

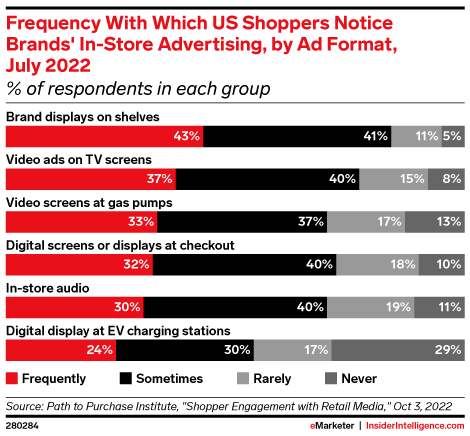

The digitization of physical spaces requires a delicate balance: retailers need to ensure they’re delivering the kind of ads consumers want to interact with in stores, not turning them off from a potential purchase. That starts with the creative itself; eMarketer reported that 22% of US shoppers are attracted to in-store ads that are eye-catching and unique.

The same study found that consumers are also looking for information; with 32% believing that the most desired feature of in-store retail media was info about a promotion or sale and 19% wanting to be reminded about products they need to buy.

Source: Sixteen:Nine

From front-of-store kiosks and between-aisle signage to digital shelving and checkout aisles, the possibilities for digital in-store signage are almost endless. But you have to be thoughtful with your choices in a physical space: no one wants to shop in a pop-up ad come to life or feel creeped out by what an ad seems to know about your shopping habits.

Source: eMarketer

And you’ll hear about what’s not working if you are experimenting in this space; customers notice in-store advertising and they’re not shy about letting brands know if they find it annoying or frustrating.

This is a big opportunity for brands to find new ways of interacting with customers close to the purchase point; it’s also a major opportunity for non-Amazon retailers to marry the data collection and ad capabilities of a digital RMN with the in-store experience—and challenge the ecommerce giant.

The other arena? Partnerships.

The next phase: partnerships will serve as a competitive differentiator for retail media networks

Like the legendary combos of peanut butter and jelly, Shrek and Donkey, or Hall and Oates, a great partnership can be magic. RMNs are working on generating a similar type of wizardry by establishing partnerships with social media companies, streaming platforms, and publishers to reach consumers higher up the funnel.

On the flip side, those partners can leverage relationships with RMNs to gain access to their much more expansive ad and data capabilities.

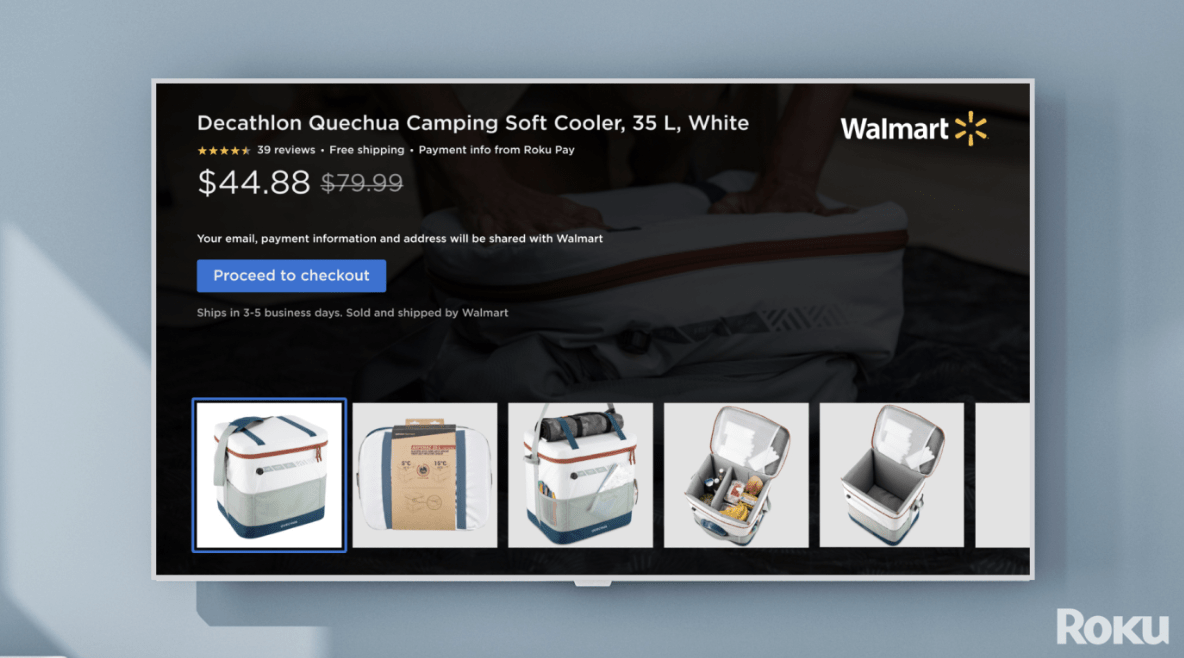

Source: Tech Crunch

Recent partnerships that are shaking the retail media world up include:

- Kroger teaming up with Disney Advertising to help brands target audiences via streaming media

- Albertsons targeting on CTV through its partnership with Omnicom Media Group

- Dollar General becoming the first retailer to offer Meta’s new closed-loop ad solution

- Walmart partnering with Roku, TikTok, and Snap to better measure how social media and CTV ads influence consumers’ purchase decisions

This trend toward mutually beneficial partnerships doesn’t show any signs of stopping because RMNs need to keep carving out competitive advantages to differentiate themselves and try to pull market share from Amazon (and each other).

We’re likely still years away from the Walmarts, Targets, and Instacarts of the world fully toppling the empire Amazon has created (and is still growing), but they are making headway. What we’re seeing now offers a glimpse into how the industry will change and grow in the future, and that glimpse can give you an idea of the path forward for your business.

The biggest lesson? Don’t get stuck in an Amazon-only perspective about retail media. Your business needs to get ready to take full advantage of this race for dominance and eventual kaiju-level battle between retail giants, because they’ll be pulling out the big guns in terms of offering new and competing capabilities.

You can get started by:

- Researching different retail media networks and their unique partnerships

- Consider how the current offerings of each RMN align with your overall business goals, audiences, and marketing strategy

- Allocate a portion of your retail media budget to start testing into some new networks (but make sure not to spread your dollars too thin)

- Scale what works and make it a part of your business-as-usual media mix

Responses