Before reading any further, answer this question: what would you rather see at the end of the month, an increase in revenue or an increase in profit? In almost every case, the answer is profit.

For decades, Wall Street and the finance industry have used profit as the gold standard for metrics, and yet the success of marketing campaigns is judged on revenue metrics. Revenue is translated to us via a metric we are all familiar with, conversions. Fundamentally, monitoring conversions makes sense, as it leads us to quick and decisive answers about the performance of marketing efforts. However, the distinction between measuring conversions and revenue, and measuring profitability is that profitability leads us not only to an answer–but to the right answer.

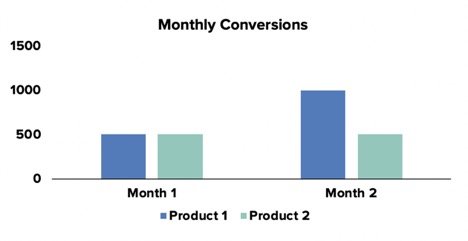

The chart above shows Product 1 increasing conversions by 100% month over month (MoM). Pop the champagne, move the entire budget towards targeting Product 1, we found ourselves a winner. Product 2, on the other hand, is flat and has an incremental lift in MoM conversions of 0%. Fire anyone that ever even thought about Product 2, remove Product 2 from the product catalog, Product 2 never existed. This is some rash decision making, as well as a simplistic example, but the data here shows a clear indication that our efforts should be adjusted and funneled towards Product 1.

In our example, businesses have found a quick series of logical steps and a decisive answer: conversions for Product 1 have skyrocketed, increase efforts towards Product 1. What if we introduce new information? Let’s say that Product 1 has a profit margin of $1.00, while Product 2 has a profit margin of $5.00.

Things are beginning to look different after accounting for profitability. Product 2 is generating more profit for our business than Product 1, even though conversions of Product 1 have increased dramatically.

Since healthier profits lead to healthier companies, we now have a new answer: we must increase sales of Product 2.

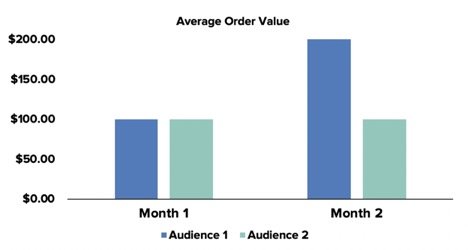

The power of profitability persists as we examine audiences and use another metric that marketers often seek to increase: Average Order Value (AoV).

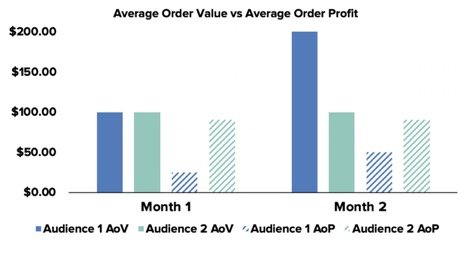

Chalk this up as another win for the team. Audience 1’s AoV has increased by 100% and revenue growth is exploding. Let’s take a second look but this time let’s measure for Average Order Profit (AoP) rather than AoV. For our example, we’ll say that Audience 1 is only buying variations of a product that carries a profit margin of $2.50 and increased the number of items per order from 10 to 20, while Audience 2 is in love with a product that generates a profit margin of $9.00 but continues to only buy 10 per order.

Going strictly off of AoV, the normal line of thinking would lead us to put more effort into Audience 1. We’d create lookalike audiences and remarket to customers that fall into Audience 1 and spend less effort on Audience 2. However, AoP shows the exact opposite. We should still be ecstatic that the AoP of Audience 1 has doubled, but our time and efforts should be weighted towards increasing sales for Audience 2.

So how do we start measuring for profit? In order to reach profit margins, Cost of Goods Sold (COGS) data about each product must be pushed into an analytics platform or any ad, analytics, or CRM platform the marketing team is using. There are three ways to accomplish this.

- Dynamically via the dataLayer

- Statically as a point in time upload to an analytics platform

- Statically through lookup tables in a tag management system (TMS)

Using The dataLayer

The dataLayer exists behind the scenes of websites as a location to store information that can be pulled in by tags set up in a tag management system or other pixels. Information appears as key-value pairs (ProductName: White T-Shirt). Information commonly found in the dataLayer includes product name, SKU number, and price. One thing to note is that the information found in the dataLayer can be publicly viewed, but before any concerns arise about displaying cost of goods sold data in a way that the competition might see it, there are simple ways to mask the data such as creating a key which takes inputs of your choosing and links them to corresponding dollar figures.

The beauty of using the dataLayer is that the variables are captured dynamically.

The dataLayer fills in the value for the variables by reaching out to back end data or third-party sources such as a CRM or Google Sheet. This is particularly important when it comes to measuring for profitability because its benefits increase dramatically as precise metrics are available in real time, but more on that later. The information found in the dataLayer can then be sent to an analytics platform automatically, and subsequently can be used to report on profitability and create metrics such as AoP.

Static Uploads

Analytics platforms allow users to upload data and implement it in reports via custom metrics. We can take advantage of this process by creating a spreadsheet with a product catalog and corresponding COGS data and uploading the spreadsheet into the analytics platform.

Lookup Tables In A Tag Management System

Advertisers can create lookup tables in a tag management system that matches SKU data to an associated cost of goods sold. The TMS can then take this data and push it through to an analytics platform.

dataLayer vs. Uploads And Tables

Utilizing the dataLayer is a much more powerful and efficient method of providing COGS data. Since the dataLayer pulls information dynamically, maintaining accurate COGS simply requires updating the figures where the COGS data is stored and leaving the rest up to the dataLayer and events tracking to gather and push into an analytics platform. Keeping up to date COGS data via uploads or lookup tables requires more effort. A new upload or edit must be made each time the cost of goods sold data changes for any product or any product is added or removed from the product catalog. The amount of effort required via the upload or lookup table process often leads companies to do updates at set intervals and apply the COGS at the time of the update as the cost of goods sold for the entire interval. By doing so, the information provided by measuring for profitability becomes murky and insights are harder to glean.

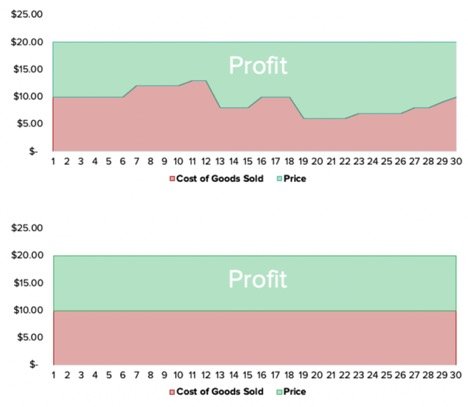

Let’s look at two months of data, one with COGS data updated daily and pushed through the dataLayer and the other with COGS entered at the end of the month via upload and a static COGS applied for the entire period.

By updating the information daily, there is much more context and information for advertisers to utilize. The point in time update provides inaccurate information for the total profit and COGS for the month and affords no insights into daily profit margins or inter-month trends. This information is important to advertisers as they make decisions about their marketing efforts. Using the charts above as an example, advertisers could leverage the fact that there was a significant decrease in the COGS beginning on the 19th day of the month and increase their bidding for high-value ad placements to increase sales.

Overall Benefits

Regardless of whether you opt to utilize the dataLayer or upload COGS data directly into an analytics platform, the inclusion of profitability opens an entirely new paradigm for businesses. Marketing objectives begin to align directly with the bottom line of the balance sheet as metrics such as return on ad spend and revenue per session become profit on ad spend and profit per session. We saw how objectives such as remarketing, lookalike audience creation, and product budgeting become more powerful with the implementation of profitability. However, the inclusion of profitability also allows companies to create sales strategies like pairing the popularity of a new product with the profit margins of an existing product to offer new bundles to customers. The era of cloudy decision making in marketing is coming to a close and the new way of making accurate choices begins with measuring for profitability.

Responses