When the COVID-19 pandemic hit, financial institutions, like other businesses, had to adjust quickly. Retail banks started migrating to a digital-first mindset, as people had limited access to branches or wanted to avoid in-person contact. Customers who hadn’t banked remotely before were suddenly pushed to use online and mobile tools—and it looks like the shift to digital banking is here to stay.

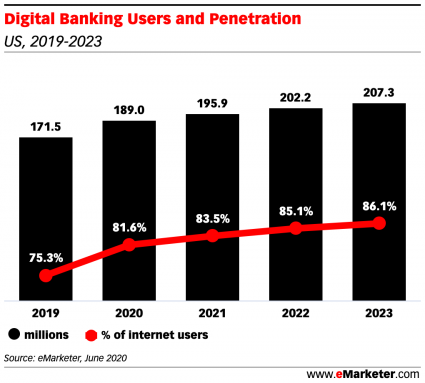

eMarketer forecasts that by 2023 there will be 207.3 million US digital banking users. According to a Boston Consulting Group global poll, the coronavirus pandemic drove 12% of the people polled to enroll in online or mobile banking. One in four people surveyed said they plan to use branches less or stop visiting branches altogether even when the pandemic is over.

Is your bank’s content keeping up with these changes?

Improve customer retention and generate growth by creating content built for digital banking newcomers. The right content will help your customers manage their banking needs remotely with confidence during these unique times—and build a lasting relationship between those customers and your bank.

So how do you make valuable content that encourages new customers to choose to bank with your institution?

Speak to specific audiences by getting to know the customer voice

You have access to a lot of insights about your customers, and you need to translate those insights into content that addresses key customer segments. Understanding their needs, challenges, and questions is key to a successful content strategy.

Many of the newest digital banking users are seniors, so creating content that specifically speaks to a less digitally savvy audience is important. One great example is Capital One’s “Ready, Set, Bank” instructional video series that educates senior citizens on various mobile and online banking subjects.

A July 2020 study by Lightico found that older customers are “just as likely to likely to complete online financial transactions as younger people.” The one significant difference? The seniors were more worried about security. So think about addressing issues regarding safety, fraud, and privacy in your content.

Create helpful top-of-funnel content that isn’t pushing product

While you can drive customers to your content through email, print, paid search, and social channels, it’s also important to consider organic SEO. Simply expanding the content on your existing pages with keyword-rich copy can give a boost to your rankings, but you need to go beyond that.

Consider what top-of-funnel content you could create to attract new customers. You can cast a wide net with helpful, educational content that is optimized for search, like “How to manage your budget online,” “Avoiding coronavirus scams,” or “Identity theft best practices.”

Educate—even when you’re promoting a product or service

Content should anticipate questions and answer them, especially when talking to a new audience of potential customers. Promoting your mobile banking app? Don’t just tell users to download: give them step-by-step directions for how to download it, complete with visuals. Emphasize the essential features and benefits of the app. Is it free? Is it secure? What can you do with it? Explain everything.

Do the same for e-statements, mobile checking deposits, online money transfers, and other mobile and online banking tools. You’ll alleviate consumer confusion and minimize customer service calls.

Connect with customers through educational content by:

- Expanding your product and landing pages with detailed information

- Creating an infographic that uses visuals to explain key concepts or benefits of some of your tools

- Sending a targeted email that is built for a specific segment of your audience, directly addressing their concerns or challenges

- Writing blogs about the benefits of digital banking or what users may be missing out on

Content opens up digital opportunities for new banking business

Bloomberg reported that at a conference in May, Goldman Sachs Group Inc. President John Waldron said the coronavirus crisis “is accelerating the trend toward digital banking.” The bank had experienced a 25% increase in active users on its institutional platform. Its retail arm, Marcus by Goldman Sachs, saw “a 300% surge in visits for financial articles and videos.”

Imagine a 300% increase in visitors to your website’s resource section. During this era of uncertainty, helping digital banking novices should be a part of your content strategy. You’ll reach seniors and other vulnerable groups who may be reluctant to return to branch banking for safety reasons even as stay-at-home orders get lifted. This type of content can help empower your customers, nurture your relationships with them, and increase long-term loyalty.

Ready to start thinking big picture? Sign up for the next episode of the Challenger Series, our live virtual event series, to connect with the best minds in digital marketing.

Responses