There are now countless ways people consume their favorite TV shows and movies through devices, and advertisers have more options than ever when it comes to TV. But most brands can’t afford to be everywhere all at once.

So how do you figure out the best way to reach your audiences on the largest screen in the house (and all the smaller screens they’re streaming on)?

There are five major trends that are likely to shape your TV strategy in 2023 and should inform your decisions about where and when to spend your budget. Whether you’re excited about streaming or bullish on addressable linear, these are the changes you need to take into consideration.

CTV advertising continues to grow—and gobble up marketing dollars

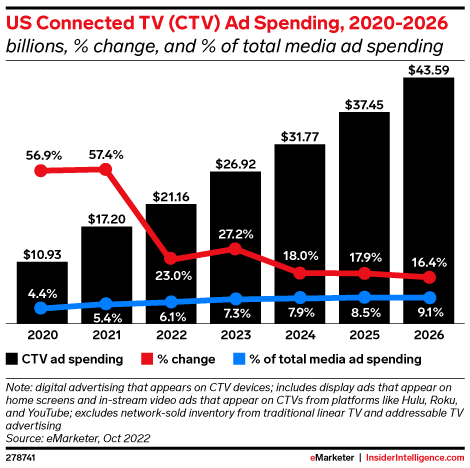

Connected TV advertising is unlikely to lose the crown for the fastest-growing format in digital ad spend any time soon, outpacing more mature rivals like search when it comes to growth. According to eMarketer, digital ad spend as a whole is projected to slow down in 2023, but CTV and retail media budgets look likely to buck the trend and continue to capture more of the marketing pie.

Source: eMarketer

The US CTV ad market in particular is projected to more than double in ad spend by 2026, according to eMarketer. And for the very first time, Nielsen revealed that people in the US spent more time streaming than watching cable or broadcast TV.

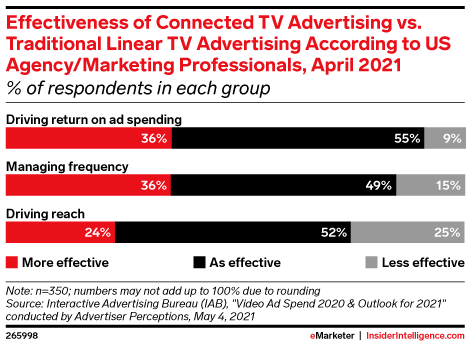

CTV offers advertisers a promising avenue for spend in a number of ways. According to eMarketer, nearly 85% of households already have a connected TV device. In addition to the appified version of TV watching, more people are watching digital video on platforms like YouTube through connected devices instead of on mobile. CTV also offers better targeting and measurement than traditional TV, as well as more flexibility around budgets and creative.

All of those factors have led to the proliferation of platforms in the CTV space, which gives advertisers a lot of options. But that glut also means marketers need to make some tough choices around where they should put money: is it with mature subscription streaming players like Hulu, or popular free services like Tubi? YouTube or Netflix’s nascent ad tier offering? Or does it make more sense to buy inventory through a cable provider/MVPD like Comcast?

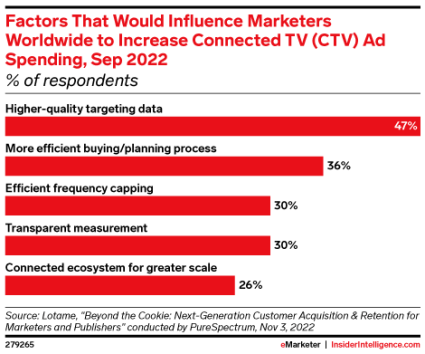

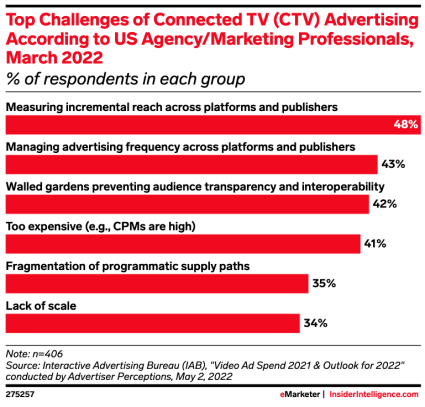

It really comes down to your audience and where they’re spending time. But it’s not all roses when it comes to finding your people or understanding the actual impact of your ads. Despite offering more targeting and measurement capabilities than linear, CTV still lags behind more mature digital offerings, which may be a bigger problem as brands shift to a profitability mindset and zero in on efficiency through a potential recession.

Source: eMarketer

The scattered nature of the buying process across device companies, TV networks, and set-top-box-makers is also new ground for many brands, and they may struggle to create a unified strategy unless they have a strong sense of how CTV fits into the larger marketing strategy and contributes to their most important business goals.

Programmatic ad buys are gaining ground on TV across connected and linear

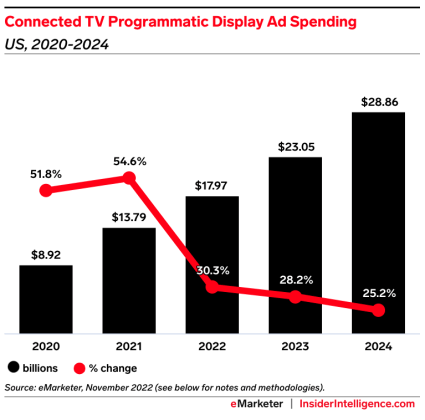

Last year, CTV accounted for more than one-fifth of total programmatic video ad spending, including one-tenth of all programmatic digital display. The ability to buy and sell ads programmatically has been an essential part of CTV’s rapid rise.

Source: eMarketer

In addition to making the buying process much easier for advertisers than traditional TV upfronts, programmatic technology unlocks many of the benefits of digital: access to automation, more flexible terms so advertisers can make adjustments in close to real time, and better sightlines into both targeting and performance.

But the next frontier is connecting programmatic technology to addressable advertising across both CTV and linear. Even though CTV is growing quickly, most TV watching time (when you combine cable and broadcast) is still linear.

eMarketer predicts that US linear TV ad spending will remain flat, but more of those dollars will go toward addressable and programmatic. They estimate that advertisers spent $6.9 billion on linear programmatic ads in 2022, predicting an increase to $8.42 billion by 2024. But programmatic solutions will need to bridge a significant gap between expectations driven by digital ad experience in other channels and the reality of TV.

Pooja Midha, EVP of Effectv, the ad sales division of Comcast, explained to AdExchanger that “programmatic technology was designed for a very different ecosystem – specifically, digital display and short-form video environments online that are awash in supply. But ad inventory is much scarcer on television and mostly bought against direct deals, so programmatic buying needs to be applied differently for TV.”

She points to the likelihood that programmatic tech will be applied to deals negotiated directly as advertisers’ demand for more programmatic capabilities grows. Programmatic ad buys will also need to contend with the higher quality standards required for TV advertising, which adds an additional layer of potential complications not present in traditional digital channels.

Addressable TV offers the best chance to build a fully integrated converged TV strategy

Because CTV and linear ad buying are often siloed across different teams, delivering a seamless viewing experience for viewers is a challenge. But one of the bright spots is addressable TV; eMarketer projects that US linear addressable TV ad spending will grow by a compound annual rate of 21.7% to $4.22 billion by 2023.

That number represents a shift in where linear TV dollars are going, not actual growth in linear TV spend. With linear inventory shrinking, buyers need to make more of the available inventory, and addressable offers better targeting, which helps marketers reach the right audiences, and improved measurement, which helps marketers articulate ROI.

Source: eMarketer

It’s not without risks. Hypertargeting can reduce the power of one of linear TV’s biggest selling points: scale. Marketers need to be smart about how they’re leveraging addressability in service of their business goals.

Renewed interest on the buyer side has led to new offerings on the seller side. Recent examples include Roku, which now offers a dynamic linear ads product that enables automatic content recognition by replacing regular linear ads with personalized ads. AMC Network teamed with FreeWheel to launch a self-service linear addressable solution that aggregates addressable inventory across multi-screen campaigns.

Addressable TV remains the best hope for bringing linear and CTV together under one strategy because it lets advertisers take a more holistic, audience-based approach to buying inventory.

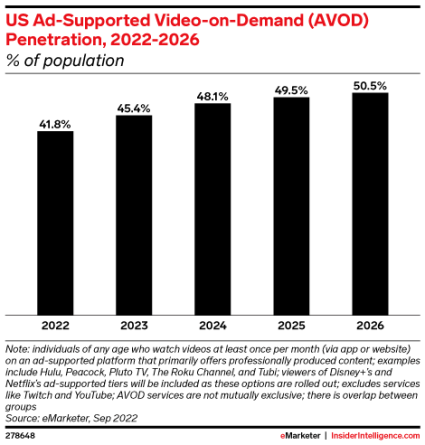

AVOD will get really popular, with Netflix and Disney+ leading the charge

There was no bigger indicator that ad-supported video-on-demand (AVOD) is one of the biggest opportunities in marketing right now than Netflix finally biting the bullet and entering the advertising arena in Q4 2022. eMarketer estimates that more than half of all internet users will watch content through AVOD services (Netflix, Hulu, Disney+, Tubi, etc.) in 2023.

Source: eMarketer

AVOD users often use more than one AVOD service at a time. Services like Roku, Tubi, and Pluto TV each had more than 50 million users in 2022, but net new growth will likely come from new hybrid models like Netflix and Disney+. Both streamers are taking a page out of Peacock’s playbook by adding a free ad-supported tier to their services. That represents a big change in the industry; both streaming platforms are subscription-based businesses, but slowing growth and difficult market conditions in 2022 led to both entering the AVOD arena.

That’s an exciting change for advertisers; marquee streaming services bring a large fanbase and a lot of inventory to the table, and are likely to reshape TV budgets in their image if their AVOD offerings bring more eyes and fulfill expectations around targeting and measurement set by more mature AVOD platforms like Peacock and Hulu. While free AVOD platforms such as Roku, Tubi, and Pluto offer good opportunities for advertisers, their market share is projected to slip over the next few years as the field gets more crowded and competition for ad dollars gets fierce.

It’s worth noting that Netflix’s initial entry in the market did not go smoothly, leading the streamer to refund money to advertisers after they didn’t hit viewership targets, but don’t count the OG streamer out. They are motivated to fix the current slate of issues that were likely largely due to a premature rush to market ahead of the holiday season.

The biggest challenge to TV advertising is still measurement, especially in a potential recession

It’s no secret that TV measurement lags behind its digital counterparts, even in high-growth areas like CTV. There is no perfect solution for TV ad measurement right now, nor one that translates universally to brands across the board.

Linear TV still relies on the imperfect-but-accepted Nielson standard, but CTV has no corresponding standard, imperfect or otherwise. Industry experts predict that we are still years away from finding a solution for the TV and video ad measurement space that creates a clearer picture.

Source: eMarketer

The growing complexity of the ecosystem has only exacerbated the problem; buyers now are dealing with traditional TV networks, standalone streaming services, Smart TV manufacturers, multichannel video programming distributors (MVPDs), and many other intermediaries, as well as measurement solutions providers.

The good news is that there is a significant opportunity for brands working with the right partners to better integrate measurement through third-party measurement solutions. Wpromote’s Growth Planner high-velocity media mix model (MMM) is one example, which leverages data taxonomy to standardize and integrate linear and CTV data with other marketing channels, then generates powerful forecasts that inform the media mix and budget allocations.

The good news is that nearly every player in the TV industry, from advertisers to agencies on the buyer side to networks, streaming services, and third-party vendors, has skin in this game, and is motivated to find or build solutions so they can be the first to get it right. The biggest hurdle on the seller side is the hoarding of first-party data that gives them a competitive advantage with buyers, even as it negatively impacts the industry as a whole.

The bottom line? Expect more ad innovation in TV this year and for the foreseeable future, especially on the measurement side, but start taking control of your own data destiny in tandem with your partners.

Responses