Brands are hungry for attention, and it’s only getting harder to stop people in their tracks and get them to focus, especially if what you’re trying to get them to focus on is an ad. Marketers looking to break through the noise and differentiate their brands from competitors face a tough battle.

But looking for opportunities to capture attention is just the beginning. Do marketers even know when they succeed? And how can they connect the hard work of grabbing attention to business outcomes?

Advertisers have traditionally relied on viewability and engagement as proxies for attention, but they only indicate whether or not a consumer has seen an ad and clicked, reacted, or commented. These metrics only give you a partial view of actual attention.

There are new solutions in the market that aim to take attention metrics to a new level. But before adding anything to your measurement framework, you need to understand what these metrics are, what they actually tell us, and how to use them to evaluate campaigns.

What are attention metrics?

Viewability is the current industry standard standing in for attention, and it answers a very specific question: could a user see the ad? But knowing that a viewer potentially viewed an ad or that it loaded on a screen in front of someone doesn’t really give advertisers enough information about whether or not it did what it was supposed to do.

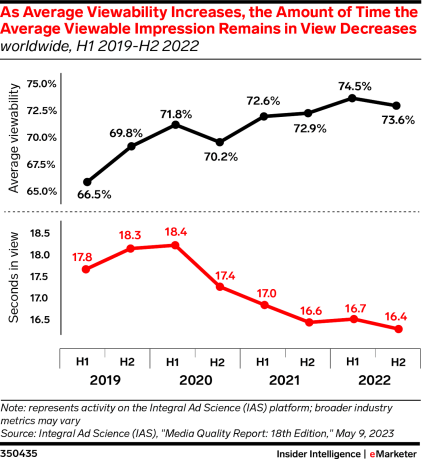

According to eMarketer, global viewability is trending up, but consumers are spending less and less time viewing each ad. If you weren’t already convinced that viewability has some critical limitations when it comes to evaluating attention, that stat alone should serve as a wake-up call.

Source: eMarketer

We’re left asking: is there a better way?

Enter a new species of attention metrics, now in the market. They aim to use a variety of data points to model the likelihood that specific media and creative combinations will get an audience to (you guessed it) pay attention.

Attention metrics are predictive, and the exact data points aren’t the same across every offering. To forecast whether or not people will pay attention to an ad, most attention measurement providers use a proprietary combination of:

- Biometric data like eye tracking, facial recognition, brain waves, heart rate, blood pressure, and more

- Machine-learning model that predicts the type of media content and creative a specific audience will pay attention to

- Data signals like viewability, time in view, dwell time, contextual alignment, cursor hover time, scroll depth, click-through rate, and audio volume level

It’s not all smooth sailing: several headwinds are slowing the widespread adoption of attention metrics, including a lack of standardization across media environments, skepticism around how they work and potential transparency challenges with providers, and some privacy-related controversy about data collection, particularly biometric data.

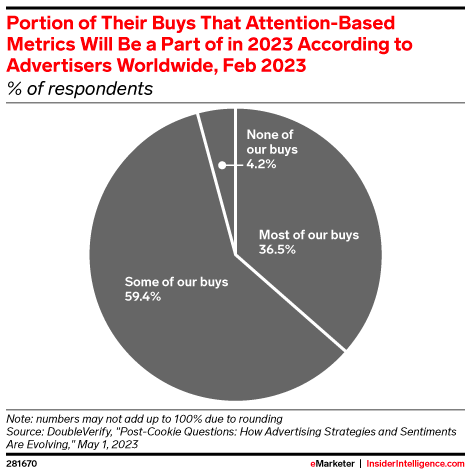

But they are fast gaining momentum with advertisers who want to get insights into consumer behavior beyond basic questions like “did my ad get served?” and “did my ad convert?”

Source: eMarketer

Right now, attention metrics look poised to take a place in marketers’ optimization and measurement toolboxes, but the bigger question is whether or not it can ever be used as currency the same way viewability is: to transact with when buying ads. That’s a much higher bar, and it’s not taking the crown from viewability yet. But it may be the next frontier.

That means you have a chance to add a valuable signal to your measurement strategy early—or risk getting left behind. Consider taking them for a test run, looking to correlate attention metrics with more concrete KPIs down the line. But first you’ll have to decide which one is the right one for your business.

Evaluating attention measurement solutions in the market

Some of the major players in the attention space right now include Adelaide, Lumen, and Playground xyz. They all use different methodologies to measure attention.

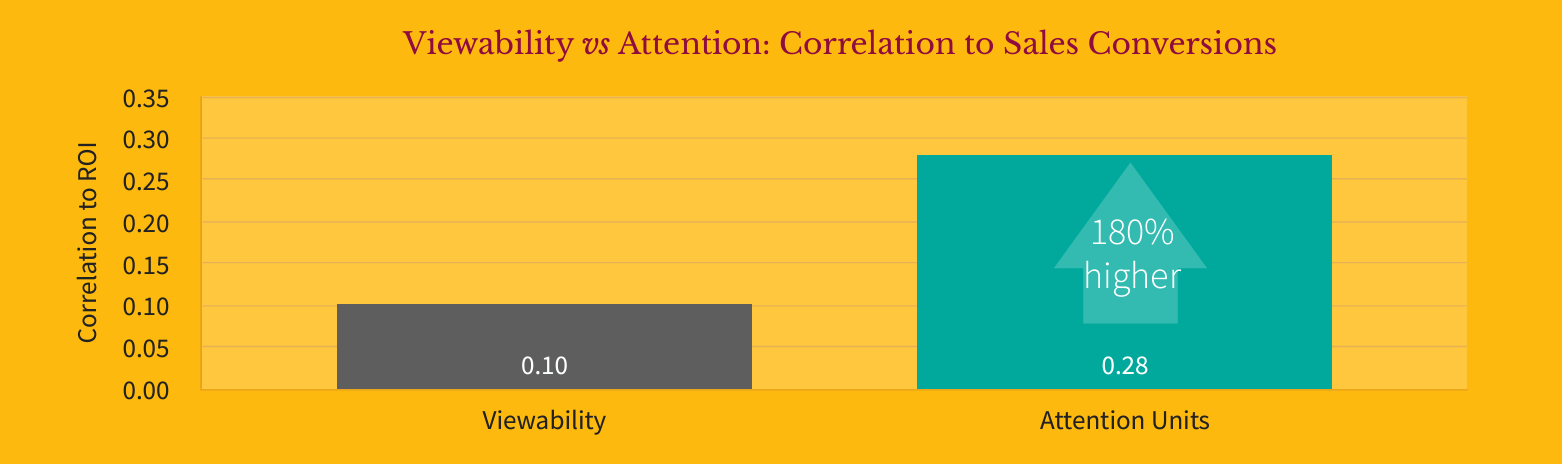

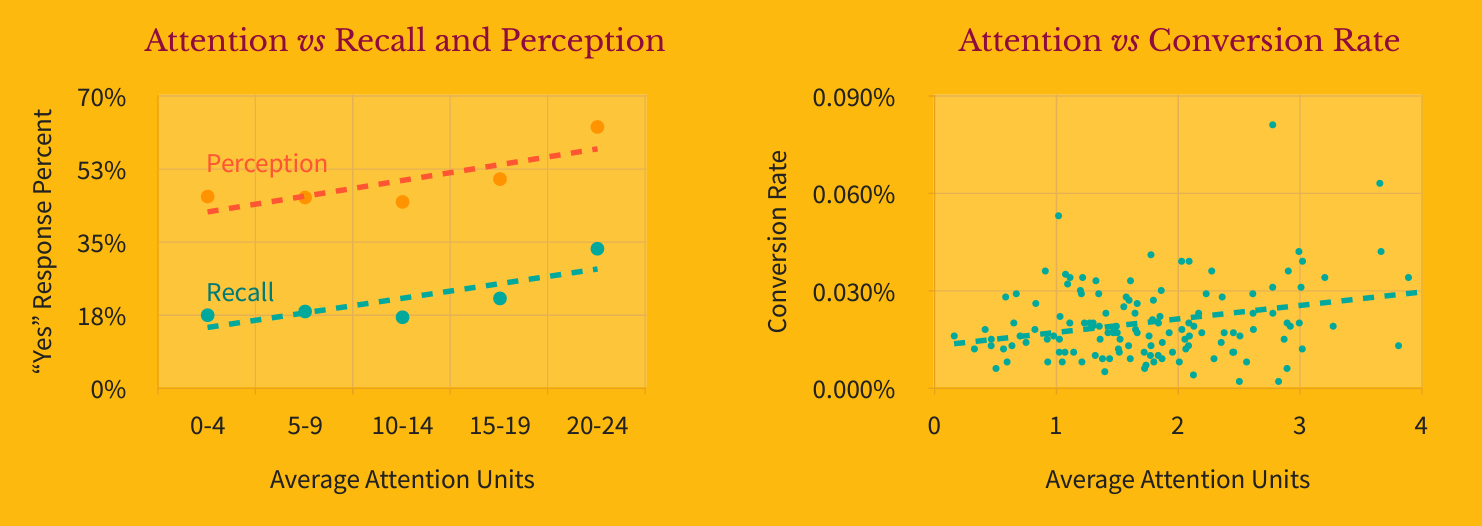

Adelaide has their own omnichannel metric that measures the likelihood that attention will be paid by any person to any creative in an ad placement on a scale from 1-100, across all platforms. They’ve partnered with the ANA on research that makes a strong case for how their attention metric measures up against viewability when it comes to correlating with brand impact, perception, recall, conversion, and lower costs. We currently consider Adelaide the front-runner among attention metrics providers.

Source: ANA/Adelaide

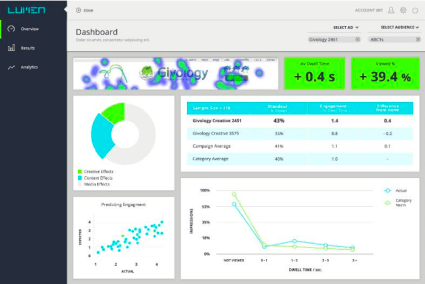

The Lumen Attention Measurement Platform uses proprietary eye tracking panel to power its own predictive attention model, which advertisers can use to assess the attention paid to digital ads. It’s a close second behind Adelaide, but it can only evaluate visual attention, which is a challenge on environments reliant on sound, like podcasts, TikTok, or YouTube.

Source: Lumen

Playground xyz’s platform is built around Attention Time, the length of time in seconds that an ad is actually looked at. That metric is based on real eye-tracking data and (you guessed it) a proprietary model, that can then be scaled and used in real-time for optimization.

Source: Playground xyz

As you evaluate different options, keep in mind that consistency in measurement is key to a more effective, integrated strategy: consider which channels are most important to your business and how attention metrics can help fuel better optimizations on those platforms—and across platforms.

Then the real work begins: finding the right ad types, creative, and media mix that takes attention into account as a performance signal.

How to build attention-driving marketing campaigns using interactive formats like AR

When you add attention metrics to your measurement arsenal, you’ll likely need to evaluate your current strategy and reconsider the kind of ads you’re running. Other factors will obviously still play a major role, but you should start testing into high-attention ad formats where they make sense for your business.

Video games and augmented reality (AR) are frequently mentioned as high-attention, immersive environments in this conversation. Both involved interactive elements that generate a less passive experience for users. They also show up most frequently in media environments where users are primed to have fun.

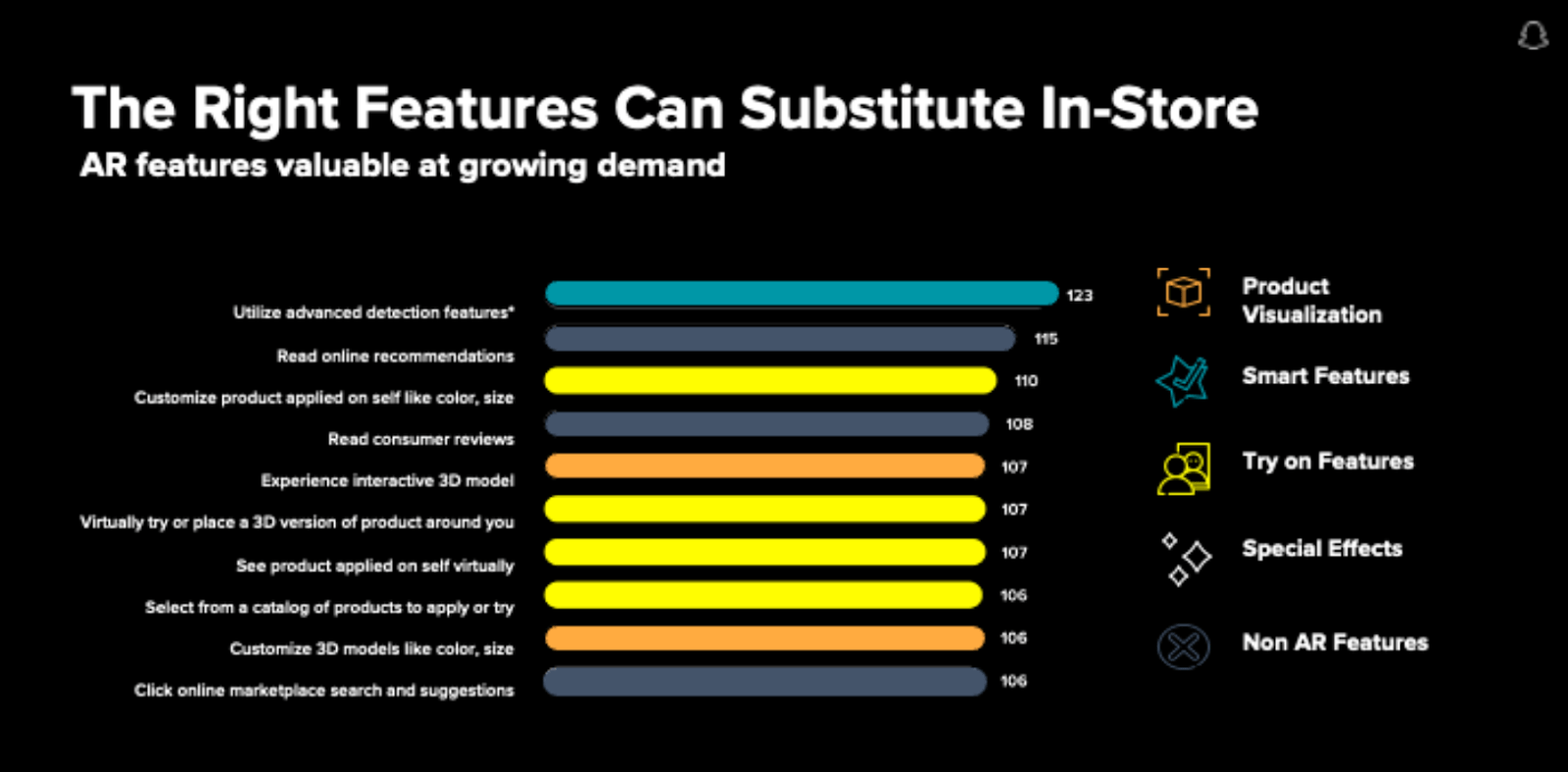

When it comes to AR, Snapchat is undoubtedly the leader in the market. The visual messaging app is highly trusted by its loyal users, and provides a very brand-safe that feels more personal and playful than many of its competitors. Snap’s AR offering Lenses is widely adopted by users across the platform, and many consumers are already using it to interact with products in a virtual environment.

“We’ve found AR to be unmatched as an attention-driving format. Our research shows AR drives higher attention, impact, and recall, and we continue partnering closely with our clients to help deliver results and measure the effectiveness of their ads.”

According to Snap’s research in partnership with Deloitte, it is projected that almost 75% of the global population will be frequent AR users by 2025. But AR isn’t just about fun; in fact, Snap found that 67% of consumers named shopping as their top reason for using AR.

And you don’t need to take Snap’s word for it: in 2020, Shopify found that AR experiences drove a 94% higher purchase conversion rate.

So what does all of that have to do with attention?

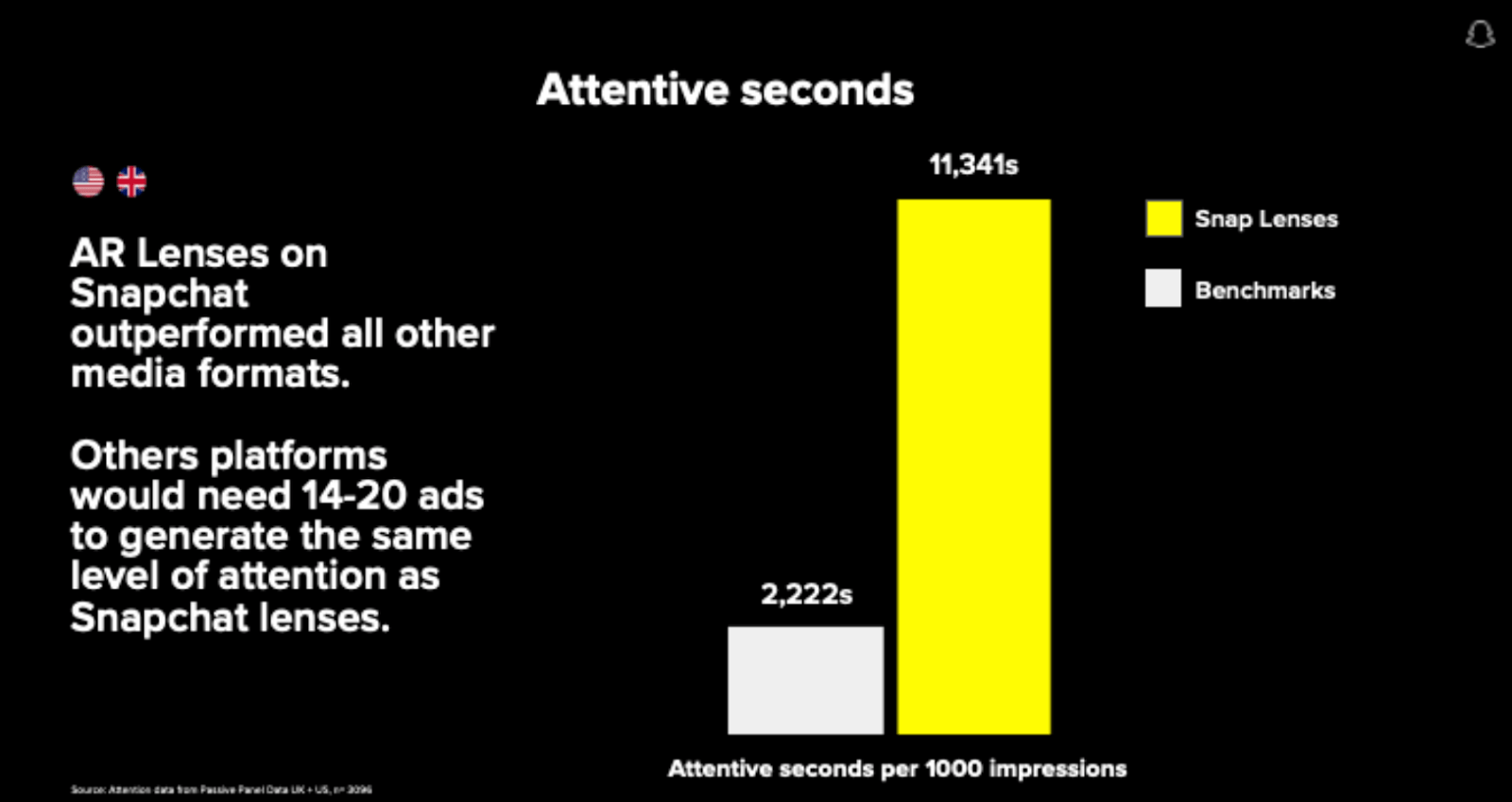

Snap partnered with Lumen to better understand how effectively its AR products capture attention—and how that level of attention could impact the brand.

To make a long story short, Snap Lenses absolutely killed it. The AR ads blew past the benchmarks set by other platforms and formats (including in-feed, in-stream, and display) to the tune of 4X. That level of attention drove 1.3x higher brand recall vs. other formats and channels.

In a separate large-scale study with Magna Media Trials, Snap found that adding AR to the media mix had an incremental impact across the funnel, driving higher purchase intent and preference.

Snap’s findings that AR captures more attention and fuels better marketing outcomes mirrors Adelaide’s research that found a strong correlation between attention and ad performance.

Source: Adelaide

The attention economy is very real: attention is a limited resource, and brands need to get proactive about capturing it—and measuring how effectively it generates the results that matter most to your business.

If you haven’t already, start evaluating attention metrics providers so you can add them to your arsenal, then use those metrics to reassess your media mix, campaign types, and creative choices to drive better outcomes for your business.

Responses