Marketers gathered this month at CES 2024 to explore the latest and greatest across the tech world. But we were there to get the inside scoop from the biggest leaders in the industry about some of the trends shaking the marketing world, from the rise of retail media networks (RMNs) to the fragmentation of the video space to the first-party data revolution.

But we know from long experience that the biggest learnings aren’t always in the massive activations or on the main stage; getting the most value out of a conference like CES requires reading between the lines.

That’s why we’re opening up and sharing the most important and unexpected things we learned at CES 2024–no lanyards required.

Video wars: the battle for attention

As we move into 2024, there’s one thing we know for sure: capturing audience attention has never been more crucial. With more options for entertainment than ever before, the rise of short-form content on YouTube and TikTok, and the decline of linear TV viewership, some marketers are shaking in their boots as they adapt to today’s consumer video behavior.

That challenge was clear at CES, where there was excitement around recent video developments like AVOD coming to Amazon Prime Video and TikTok’s focus on long-form video (a continuation of their pivot in 2023 that unlocked 10-minute videos for users).

The transition of sports, that final bastion of linear dominance, onto streaming platforms is going to play a huge role this year. Amazon in particular is leaning into Thursday Night Football as the place for brands to make advertising moves. That’s something brand new for the retail media giant: the dominance of Thursday Night Football makes it a powerful advertising option even for brands that aren’t selling products on Amazon.

Source: Amazon

So what do these video-centric platform updates mean for your marketing?

If you don’t have an integrated video strategy already, it’s time to invest in one now.

As continued media convergence erodes the divisions between different marketing disciplines, you can’t afford to plan channel by channel if you want to maximize the impact of your dollars.

According to eMarketer, the average American spends over 13 hours a day with digital media. That means your audience is in front of the screen; you just need to find the right platforms to meet them where they’re already watching.

In this ever-changing, fragmented video landscape, you need to plan your investment holistically to make sure you’re directing your dollars to the content and environments that resonate with your audience most. Remember: with this many platform options, you can’t be everywhere, so you need to choose the right platforms to get the biggest bang for your buck.

Retail media revolution: beyond products, toward partnerships

Retail media networks have been all the rage over the past few years as many legacy retailers introduce new digital capabilities, seemingly on the daily. Every marketer worth their salt knows that these opportunities to leverage retailers’ valuable first-party data to fuel advertising are critical in a post-cookie world, but it’s important to apply some due diligence before deciding where to spend your dollars.

As RMN adoption grows, different platforms are vying for advertiser attention by leaning into unique strengths and expanding their offerings. Even giants like Amazon and Walmart are working to show how they can get brands the performance and audience reach they need.

Source: Walmart

At CES, it was clear that many RMNs are evolving their positioning to capture more dollars from the rest of the advertising pie. In addition to its Thursday Night Football rights, Amazon is expanding its DSP capabilities to service non-endemic brands (capturing programmatic dollars from The Trade Desk and Google), while Albertsons and Target have decoupled their media placements and audience data.

All these new developments mean marketers need to keep a pulse on each RMN’s capabilities because they are changing fast in a race to distinguish themselves in the market. Rather than sticking to the biggest retail media players by default, teams should keep testing new platforms and evaluating different offerings to see what works best for their audience.

No matter what, RMNs’ true strength is rooted in their unique first-party data. That data is a precious commodity these days, and brands can use 1P data from RMNs for both targeting and audience insights. Wpromote has partnered with RMNs in this broader capacity since the very beginning, and we’re excited to see what else retailers do to increase reach. Watch this space–there’s sure to be more to come in 2024.

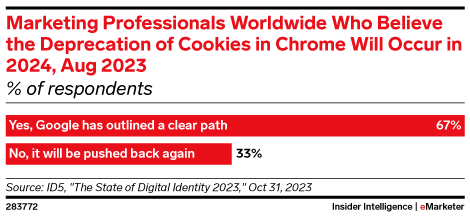

Data privacy takes center stage: embracing the first-party paradigm

As third-party cookies go the way of the dodo, activating first-party data for targeting and measurement purposes is a non-negotiable ingredient for future marketing performance.

Source: eMarketer

Almost every media partner at CES was touting their first-party data narrative as a way of trying to maintain relevance and earn a spot in the media plan. While first-party data is all the rage, take a close look at the new information sources being peddled–some companies are working to get in on the data boom by overhauling their value propositions without really offering anything new.

Of course, there are also plenty of players, like TikTok or Amazon, that are touting truly unique first-party data value propositions that can get you a much-needed competitive advantage in the ever-fragmented media landscape. But some longer-tail media mix players touting first-party data solutions may be all talk and no action.

Don’t fall for a first-party data-led narrative that is just a rebrand of yesterday’s overused “audience-first approach.” If a potential partner or platform can’t deliver on a first-party data unlock from a measurement standpoint and address ever-growing attribution blindspots through offerings like clean room analysis and closed-loop studies, their first-party data story is likely more smoke and mirrors than actual solution.

As media partners fight to stay relevant, it can be hard for less savvy advertisers to figure out who really has the capabilities they claim to offer and who’s just hopping on the 1P bandwagon. Carefully evaluate new partners before making commitments and do your research on the data your brand needs to succeed in the post-cookie future. If you make the right moves now, you’ll set your brand up for continued success in a very different world of data.

Responses