Marketers have been all-in on Gen Z over the last few years. As the generation has gotten older and started to fully emerge as a powerful consumer cohort, the industry has been abuzz with ways to reach these young, tech-savvy shoppers.

But you shouldn’t overlook their elder cohort, millennials, either: they still pack a major punch when it comes to spending, especially since they’re older and more likely to be employed.

Together, these two generations, which each make up about a fifth of the US population, form a powerful group of younger consumers. And while marketers often reduce these generations to monolithic blocks, the real picture of these cohorts and how they buy is more complicated than you might think.

Their unique and sometimes surprising spending habits are making a mark on shopping trends both today and in the future. It’s crucial to understand their priorities, similarities, and differences if you want to win. Otherwise, you might be missing out on major sources of revenue.

Is Gen Z outspending millennials?

As the older sister to Gen Z, it’s no surprise that the millennial cohort tends to spend more money overall than their younger counterparts. Those born from 1981 to 1996 are more likely to be fully settled in their grown-up lives; they’re more likely to be employed and, despite facing many economic challenges over the years, are less likely to rely on their parents as the oldest members enter their forties.

For example, millennials had higher intent to spend in the 2023 holiday season than Gen Zers, according to Statista; they planned to spend around 2000 dollars on average, compared to Gen Z’s 1300 dollars.

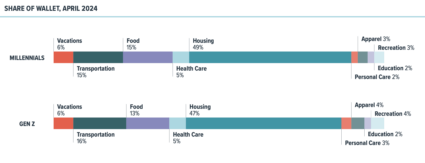

But Gen Z’s less-stable lives aren’t slowing down their spending. Instead, living with parents or cohabitating with friends, rather than on their own or with dependents, allows these younger adults to reallocate some of their spending from necessities (such as housing and food) to discretionary purchases like apparel, recreation, and personal care.

Source: Morning Consult

This has led to Gen Z actually outspending their elder cohort, even with a recent downward trend in purchases. Gen Z leads most categories in purchase power, but millennials have the edge on the number of purchases, as they’re more likely to buy multiple products each month.

But millennials may soon be spending more. Shoppers who were once holding out on buying due to recent price hikes are beginning to accept higher price levels and pull the trigger on purchases they’ve been waiting to make. We’re predicting that millennials will increase spending through the rest of 2024.

“Little treats” and self-care make Gen Z and millennials more likely to splurge

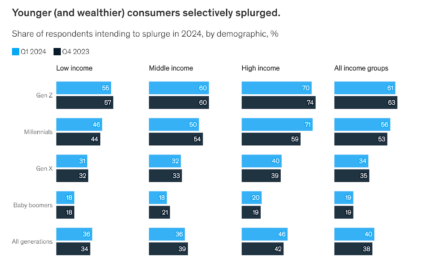

While both Gen Z and millennials have concerns about rising costs, that hasn’t stopped them from splurging when they want to. Gen Z consumers are particularly likely to treat themselves, with 55% of Gen Z consumers saying they planned to splurge, according to McKinsey. Millennials aren’t far behind at 54%, but older generations are more cautious with spending (31% of Gen X and 20% of baby boomers said they’d splurge).

Source: McKinsey

Part of the reason for younger generations’ willingness to spend might be their overall pessimism about the future. To cope with fears about the economic and political climate, they get what the internet calls a “little treat,” making emotional purchases to feel better.

Concerns about the future also mean many young people are questioning why they should save money for financial goals when the future looks bleak. An Axios Vibes survey found that the majority of millennials and Gen Zers said they’d rather spend on themselves now than keep that money for a future “that feels like it could change at any moment.”

For many young consumers, those treats are adding up to be not so little: the Axios survey also found that around 40% of those millennials and Gen Zers who say they are financially squeezed blame their money problems on their own “excessive spending on non-essentials.” In contrast, only 17% of Boomers and Gen Xers who said they were financially squeezed thought this was due to their spending.

That might be because both Gen Z and millennials’ retail therapy is at least in part bankrolled by their parents. More than 60% of Gen Z consumers say they’re relying on their parents for at least some financial support, and a smaller portion (around a third) of millennials say the same.

Both Gen Z and millennials face economic challenges

Although young consumers aren’t afraid to splurge, they’re still feeling the same financial pinch as other Americans, with rising costs, student loan repayment, and other economic challenges cutting into budgets. 73% of Gen Z said they had made changes to their spending in response to increased prices, according to a Bank of America poll.

Millennials and Gen Zers are tightening their belts by swapping their usual purchases to save money and looking for good value while shopping. According to McKinsey, 86% of Gen Z and millennial consumers reported trading down (changing their purchases for better prices or value) in Q3 of 2024. That’s higher than the 76% of consumers overall who report the same. These shoppers were also likely to change retailers for a lower price or discount.

Young consumers often save by shopping at discount retailers like T.J. Maxx and Marshalls and by buying off-brand or private label products. According to a survey by Business Insider and YouGov, 71% percent of Gen Z consumers say they sometimes or always choose cheaper versions of products rather than name brands, which has presented a big opportunity for Sam’s Club and Costco with their well-known private label items.

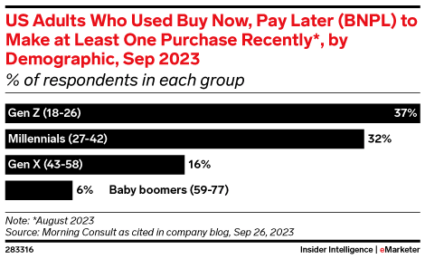

Source: eMarketer

Gen Z is also more likely than any other generation to use buy now, pay later (BNPL) services to help them make big purchases. According to Morning Consult, 37% of Gen Zers and 32% of millennials had used BNPL to make at least one purchase recently. This is in line with the generations’ tendency to splurge, even when they don’t necessarily have the cash to do it.

Reaching younger consumers takes pitch-perfect messaging

Once you understand these younger consumers and their spending, you need to find a way to market your brand that speaks to their needs. But how do you reach two generations with such contradictory shopping habits?

Gen Z and millennials value good deals and discounts, so it’s a good idea to focus messaging around your product or service’s value in comparison to other items or offerings. You can also appeal to budget-minded shoppers by hosting and advertising major sales events.

Since these consumers are drawn to low-cost retailers, you may also want to explore retail media networks associated with those businesses to get your products in front of Gen Z and millennial audiences.

For Gen Z shoppers in particular, you can tap into impulsive splurging with advertising on social platforms like TikTok, Instagram, and Snapchat (bonus points if you take advantage of social commerce options like TikTok Shop to reduce friction in the path to purchase).

You can also take advantage of emotional purchasing habits with flash sales and limited-time-only products. By creating a sense of urgency, you can encourage customers to buy in the moment and make your product their latest “little treat.”

No matter what your marketing plan may be, you should be investing in understanding these younger audiences. After all, Gen Z consumers aren’t just the future anymore–they’re a major consumer cohort you can reach right now. It’s essential to stay on top of the latest consumer trends to keep up as the market continues to evolve rapidly. We’ll be looking to Gen Alpha sooner than you think.

Responses