From major players like Amazon and Walmart to smaller platforms like Shipt and eBay, retail media networks (RMNs) have been growing rapidly in 2024. But with so many different RMNs to choose from, it can be hard to know where to invest–especially when every RMN is prioritizing different unique selling propositions (USPs) and touting new capabilities to win market share.

So how can you adapt your brand’s strategy to the changing world of retail media and make the most of your ad dollars?

We’re here to give you the lay of the land on the latest RMN updates.

Large retail media networks: earning more overall marketing budget and showcasing unique audience offerings

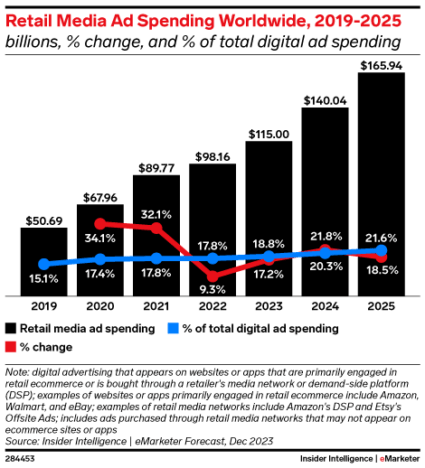

Retail media investment overall has been accelerating quickly, but each RMN is experiencing growth differently. That largely depends on the RMNs’ level of maturity and the advertising dollars they’re getting from endemic brands (brands that sell through retail channels).

Source: eMarketer

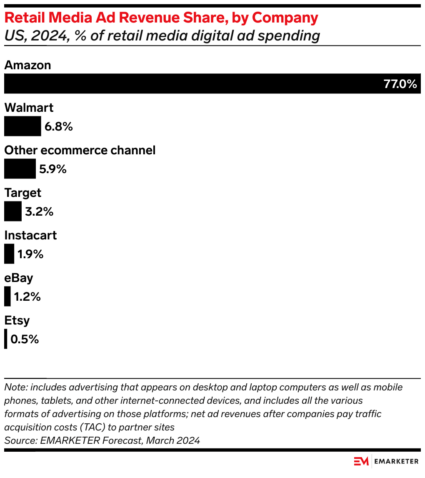

Large category leaders like Amazon and Walmart are already doing big business in on-platform retail media, so they’re focused on two things: growing share of wallet from endemic brands and expanding their advertiser base to appeal to all advertisers, even those that don’t sell on their platforms. In both cases, the goal is to win broader marketing budgets beyond the traditional scope of retail media.

Increasing share of wallet

When it comes to increasing share of wallet, look no further than Amazon’s Demand Side Platform (DSP) Connected TV (CTV) campaigns, which drive measurable impact on brand awareness and conversion volume, and Walmart’s TikTok campaigns, which are powered by first-party data targeting and including closed-loop measurement. These larger RMNs know that a winning retail strategy requires more than a winning on-platform strategy–and this is only the beginning when it comes to their expanding capabilities (looking at you, Amazon Retail DPA campaigns!).

Growing the advertiser base

While there’s still scale to be captured in growing endemic marketing budgets, Amazon and Walmart want more: they’re now targeting marketing budgets from all verticals. They’re pitching retail media ads for non-endemic brands (brands that don’t sell through these channels) by promoting their unique first-party audience data that can power targeting across media channels as data deprecation continues to impact the digital marketing industry as a whole.

Since huge retailers already have so many brands selling on their platforms, many of these non-endemic activations can come from broader verticals including financial, health, or insurance companies while leaning into their deep consumer knowledge to attract more retail and DTC brands.

Smaller and newer retail media networks: first-party data and third-party partnerships

Growth looks very different for smaller or less mature RMNs. Many smaller RMNs are leveraging their valuable first-party data to unlock more advertiser dollars by offering access to their data de-coupled from buying ads on their platforms. As stricter data privacy laws and the approaching deprecation of cookies in Google Chrome restrict advertisers’ use of third-party data, gathering reliable first-party data has become a priority across all advertisers, regardless of their retail objectives. Even if brands aren’t interested in advertising directly on RMNs, they can buy access to useful customer data.

Source: eMarketer

As the marketplace fragments and seemingly infinite possibilities for RMN investment come to market, brands are facing a tough decision: where should they spend their dollars to get access to this first-party data? In this competitive environment, RMNs that offer easy setups with turnkey integrations have an advantage. Through partnerships with TheTradeDesk, these RMNs can unlock scale through ease of testing at a low lift and low-cost barrier to entry, often as audience additions to existing media campaigns.

On the sponsored products side, smaller RMNs are leaning into third-party partners like Criteo to power their on-page ad inventory. Those partners offer access to existing RMN advertisers who may be more likely to test their inventory because of ease of integration into their broader retail ecosystem strategy.

How brands can adapt to the changing world of RMNs

Every major retailer now offers their own RMN, compounded by additional RMN solutions spun up by media partners (Meta, Google, and Pinterest, to name a few). As RMNs continue to develop and expand their offerings, brands need to make sure their overall strategy is aligned with those retail media options.

To win, you need a comprehensive understanding of how all of your marketing investments contribute to your overall commerce goals. That requires a foundational media mix aligned with your commerce priorities and optimized based on market dynamics and new testing opportunities.

That’s especially critical because fragmentation isn’t limited to the retail media landscape. Brands with siloed organizational structures and disconnected systems often miss revenue opportunities because of a lack of integration. Taking a “total commerce” approach, encompassing total marketing investment, DTC, and retail ecosystem initiatives and focused on driving business outcomes, can help you achieve greater efficiencies and incremental impact with RMNs and beyond.

To apply an integrated approach, brands should:

- Streamline the planning process across brand and retail media marketing to ensure alignment across goals, investment, campaign priorities, product opportunities, and testing roadmaps to find synergies and eliminate redundancies

- Identify creative synergies and efficiencies by leveraging consistent messaging and creative across DTC and retail channels, which can also cut down on creative post-production costs

- Build integrated flighting strategies to capture demand generated by brand awareness campaigns to maximize marketing impact

- Analyze the halo effect on overall performance, accounting for the interplay between brand and retail marketing by using holistic measurement tactics including building integrated MMM solutions to project total commerce impact and using clean room analysis to understand consumer journeys

By breaking down internal silos and considering holistic marketing impact, you can maximize your marketing investments in retail media and elsewhere, driving incremental revenue growth and unlocking efficiency through planning, execution, and measurement across full-funnel brandformance objectives.

As you plan your integrated marketing strategy for the second half of 2024, check out our white paper on the future of media convergence for the insights you need to win.

Responses