As an extension of SMX Advanced, marketers had the opportunity to attend a one-day workshop and take a deep dive into SEO, paid search, and local or international search.

Here are the highlights from the International Search Summit programmed by the international search agency WebCertain Group LTD.

Introduction & Global Search Engine Headlines By Andy Atkins-Krüger – Webcertain

In this first presentation of the day, Andy gave us an overview of the latest developments and trends in the major global search engines.

Summary/Major Takeaways:

If you’ve been living under a rock, you might not know that Google has the most market share in all countries with the exception of Russia (Yandex), China (Baidu), and South Korea (Naver).

Japan uses Yahoo Japan as their primary search engine, but this uses the Google algorithm on the backend. I’m not even going to get started on Bing…

Yandex is Russia’s most popular search engine with 60% market share and plans to expand into Turkey. Baidu leads China’s search engine market share with 58% of users. Other top search engines in China include Haosou and Sogou. Baidu recently launched in Brazil and will focus on mobile searches in Indonesia. I suspect a BRIC/MINT trend going on here (keep reading)…

International Opportunities By Gemma Birch – WebCertain

Gemma identified some of the biggest and fastest growing global markets.

Summary/Major Takeaways:

First the BRICs and now the MINTs! Do you know what BRIC means? If you’ve ever taken an Economics class, this may be a familiar phrase. BRIC is an acronym that refers to four of the world’s emerging dominant economies: Brazil, Russia, India, and China – originally coined by Jim O’Neill from Goldman Sachs in 2001.

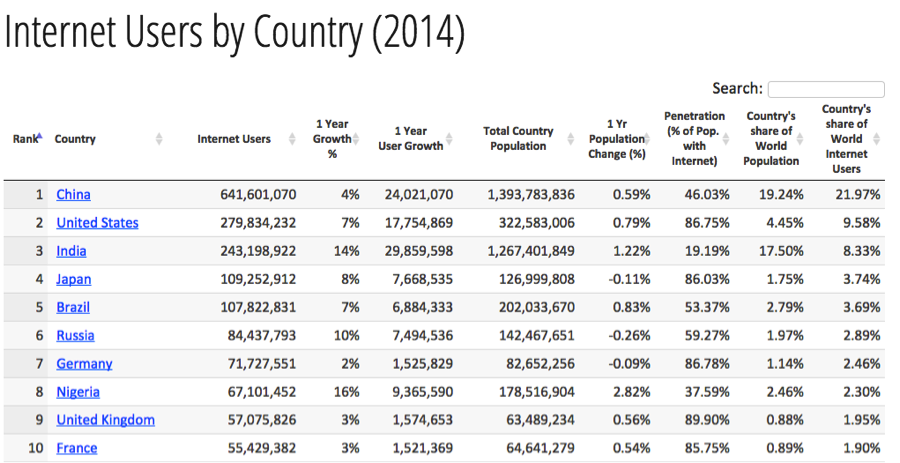

In China, there are over 640 million Internet users – a number which only represents 46% of the population! This presents an exciting opportunity for investors, businesses, and marketers alike.

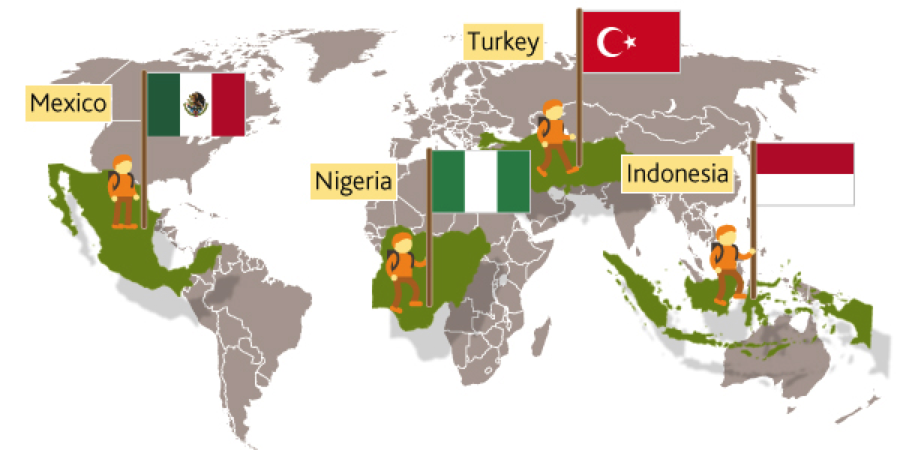

The MINTs (Mexico, Indonesia, Nigeria, and Turkey) are the next countries predicted to become economic powerhouses. Nigeria, for example, is about to undergo a GDP re-basing and may end up becoming the biggest economy in Africa. Renaissance Capital estimates that Nigeria’s economy was worth $405 billion in 2013, compared to $355 billion for South Africa.

So what does this mean for digital marketers? Well for starters, if your digital marketing strategy doesn’t incorporate the BRIC or MINT countries, you’re missing out on a HUGE opportunity. However, just because you enter these markets does not mean you will suddenly experience a major influx of conversions or sales.

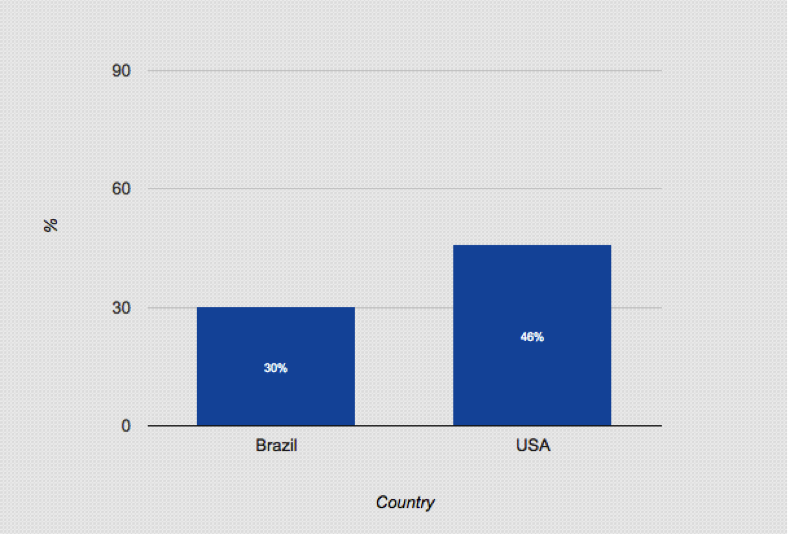

Although Internet usage and financial stability are growing, attitudes towards purchasing online are still awhile away from being similar to the online habits of users in the United States.

For example, I did a quick analysis of mobile purchases via smartphone and found that about 30% of smartphone owners in Brazil purchase via mobile while in the USA, we see that number closer to 46%.

Managing Global Digital Marketing: Find Your Flavor By Jennifer Bolton – Dato

Jennifer walked us through approaches to developing and scaling global marketing efforts with different mixes of corporate/regional team structures and external vendors with various brand maturities.

Summary/Major Takeaways:

Regardless of your brand size, it’s essential that you communicate and collaborate with your internal teams to define ownership of projects before expanding into new markets. For example, your brand may want to handle the web design and development while working with a 3rd party on content translation and localization.

If you’re new to international SEO, a good place to start would be expanding to countries that have users with a high proficiency of the English language, such as Denmark or Sweden.

Jennifer recommended the Customer Journey to Online Purchase tool to gain some insights on how the “customer journey” varies from country to country.

I also recommend the use of the Google Consumer Barometer and Mobile Planet tool for user behavior and market research when expanding into new markets. I’ve used these tools successfully in multi-lingual and multi-national SEO campaigns.

Challenges Of Social Media In Global Markets By Jeremiah Andrick – Logitech

Jeremiah discussed some of the major challenges in creating effective and scalable social campaigns. He addressed some the key differences between western and eastern approaches to social media.

Summary/Major Takeaways:

If you think managing an international digital campaign simply means translating your strategy into another language, you’re dead wrong. Social media helps bridge the gap between your brand and consumers, but this means nothing if you don’t understand your audience.

As an international SEO marketer, I totally agree that I have to adjust my process when targeting a different audience. Understanding your audience’s culture, norms, traditions, and taboos is critical from the initial keyword research process to identifying what type of content will resonate with your audience.

Jeremiah offered 3 solutions to avoid disaster:

- Your customers like your brand are unique – avoid the one size fits all approach.

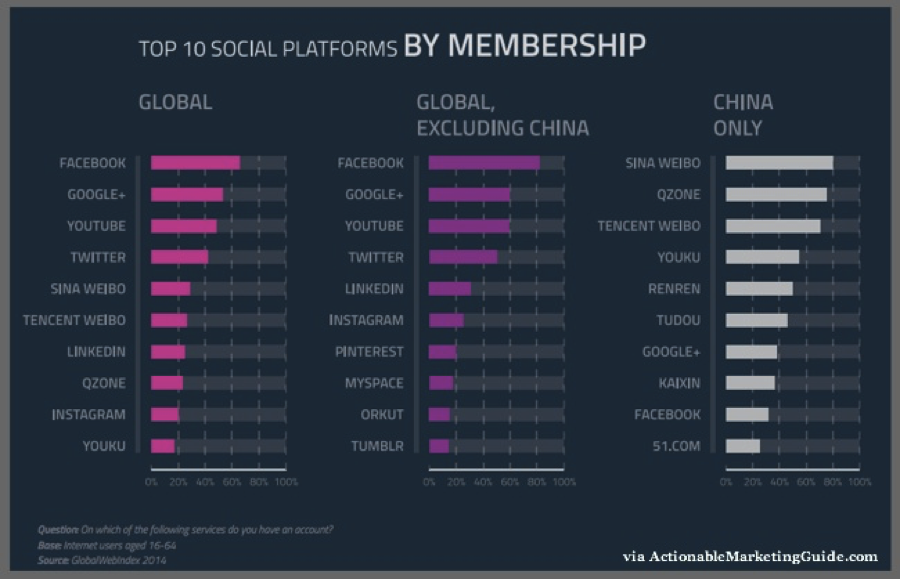

- Consider your ability to speak directly to the customer – i.e. Facebook is the primary social network in Latin America whereas Weibo dominates in China.

- Context: A translation-only approach rarely accounts for the calendar issues or social issues related to event-driven marketing. For example, New Year’s is bigger in some Asian countries than Christmas.

International Keyword Research Uncovered by Ben Lefebvre – Webcertain

Ben discussed some of the factors every marketer should consider when conducting international keyword research – from search engines to user behavior and language differences.

Summary/Major takeaways:

Transliteration, misspellings, accent droppings, character replacements, compound nouns, cases, and scripts?! This session was jam packed with all sorts of considerations every marketer needs to make when conducting international keyword research.

- Direct translation does not work because it doesn’t take into account cultural significance and local dialects. Even within the same language, I’ve seen keyword search phrases fluctuate between countries because of the differences in local slang. For example, in Central America, it’s very common to hear the term “refrigeradoras” for “refrigerator”, whereas in the Caribbean, a more commonly used phrase is “neveras.”

- Go as local as you can to find the real opportunities – some keyword phrases might be more popular in specific regions of a country.

- Expect different search patterns from one market to another – some users will search very generically and others will search more long-tail phrases.

Transliteration – Take into consideration that a transliterated phrase may have greater search volume than the literal translation. Adjust your keyword and content strategy (and URL structures) accordingly!

Examples (Country, Keyword, Search Volume)

CHINA

intel = 3,800

英特尔 = 1,500

JAPAN

intel = 15,000

インテル= 51,000

ISRAEL

intel = 5,400

אינטל = 4,400

Misspellings and Accent Droppings – In some cases, accent droppings are more popular.

Examples (Country, Keyword, Search Volume)

SPAIN

España = 165,000

Espana = 9,900

USA

España = 12,100

Espana = 22,200

Character Replacements and Compound Nouns – In some cases, you may want to keep the original characters.

GERMANY

Glück = 27,100

Glueck = 590

UK

snowman = 18,100

snow man = 1,600

Cases and Scripts – There are some languages, such as Russian, that have 6 different ways you can say the same word in just one tense. A past, present, and future tense of a word can have up to 18 combinations! Yandex gives you the same search volume for these 18 combinations.

RUSSIA (Yandex)

кошка = 3,677,180

кошки = 3,677,180

кошке = 3,677,180

кошку = 3,677,180

кошкой = 3,677,180

RUSSIA (Google)

кошка = 27,100

кошки = 49,500

кошке = 30

кошку = 260

кошкой = 20

Ben used Google Keyword Planner, Yandex Keyword Statistics, and Baidu Keyword Tool Editor to gather data on search volume by country.

I also like to use BrightEdge, SEMRush, and Google Trends for international keyword research.

Responses